Finland is in desperate need of growth. The creation of new jobs appear to be focused on small and medium-sized, growing businesses. This does not, however, exempt established companies from the responsibility of striving for growth. Revitalizing development and investment projects provide a foundation for growth. A project portfolio is an efficient management tool for choosing and prioritizing such projects.

Need for reformation

Many of the problems of traditional companies stem from the inability to reform in a prudent and timely fashion. In her book, The End of Competitive Advantage, Rita Gunther McGrath claims that any competitive edge is temporary, and disappears at an increasingly fast rate. Companies must continuously evaluate their operations, develop new approaches and to relinquish old approaches in continuous, partly overlapping cycles.

A company that fails to recognize the need to develop in time is forced to take quick measures that it may not have prepared for. Corporate acquisitions are often the only way to change, but there is no guarantee such moves are successful.

Nature of growth

Growth is not a linear, but a dynamic process involving learning, experimentation and errors. Professor Edward D. Hess has studied businesses with unusual paths to growth (Harvard Business Review, October 10, 2011). The companies Hess studied shared a simplified, focused strategy. They did not provide unique products or services. Furthermore, the companies were not exceptionally innovative or visionary. They did, however, share a mindset emphasizing growth combined with a systematic approach and experimental learning.

A project portfolio is part of the systematic management of growth. The portfolio enables a company to evaluate and choose growth projects, manage them as an entity and to make decisions according to the prevailing status.

Growth projects in the project portfolio

The project portfolio comprises programs and projects that are managed as an entity in order to reach strategic goals. Corporate management should emphasize projects that strive for growth, rather than projects that merely secure business turnover.

Growth types and timeframes

Growth projects can be aimed at increasing sales or improving the efficiency of business operations through cost-cutting or by increasing productivity.

Such projects may have different timeframes. Companies can look to yield results within a matter of a few years or in the long term. Projects that aim for quick results are typically focused on improving efficiency. Increasing sales through product launches and entering new markets is more time consuming and challenging.

Growth types

Growth can be attained by different methods that can be beneficial in terms of increasing both sales and efficiency. Growth projects can develop business operations in the following ways:

- Improvement – E.g. improvements in quality of operations and results, speeding up processes, increasing the efficiency of data management and production

- Innovations – Product or service innovations, technological innovation, market innovations or organizational innovations

- Expansion– Expansion into new market sections or markets, product or service expansions

- Strategic acquisitions – Expansion into new regions, new client segments, product, technology, etc.

As regards project prioritization, growth types are correlated to financial resources and the ability to reform. For example, launching new medical products is much slower in comparison to IT product launches.

Growth project risks

There are two key aspects related to prioritizing growth project-related risks: chances of success and financial repercussions. The following classification may be useful in project prioritization:

Level 1: Good chances of success AND low financial risks

Level 2: Moderate chances of success OR moderate financial risks

Level 3: Poor chances of success OR high financial risks

Another, supplementary way to quantify project risks is to evaluate the feasibility of the project’s budget, resource requirements and schedule. With the help of these methods, experts can form three-point evaluations: the best, the worst and the most likely scenario.

Compatibility

The aforementioned criteria should be supplemented with a compatibility assessment. Is the project pursuant to the company strategy? How well does the project match with core competences, organizational structure, culture or the IT architecture? The portfolio should also focus on evaluating the compatibility of various projects with other growth projects in the portfolio. These compatibility criteria can be evaluated on a three-step chart: low, moderate, high.

Growth efficiency

Naturally, the key criteria in the prioritization of growth projects are economic impacts and investment requirements. These factors can be quantified, for example, with a scale of 0 to 5. The figures on the scale can be assigned values to quantify the criteria: e.g. in terms of positive cash flow, 5 could mean less than 1 year and 0 could mean over 3 years.

Growth efficiency-related factors include, e.g., potential financial yield and time until positive cash flow. Negative factors include, e.g., staff resource and investment requirements.

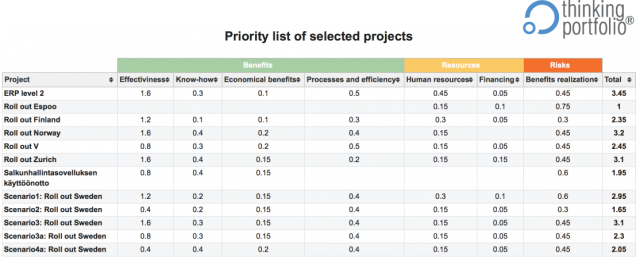

Figure 1. Table depicting growth efficiency and compatibility

Portfolio prioritization

The aforementioned criteria can be placed on a four-cell table in order to evaluate and prioritize growth projects (Figure 2). The criteria should be quantified in order to achieve more useful comparisons.

Growth is a dynamic, experimental process, which requires that the management is able to handle uncertainty and allow for experimentation. Mathematic optimization models provide a solid foundation for decision-making, but they should not be allowed to only yield zero-risk decisions.

Figure 2. Growth project evaluation table.